What Property Owners Should Know About Airbnb Taxes

Tax Realities for Airbnb Hosts

The IRS tracks every cent you make from short-term rentals. Airbnb deposits, cash payments, it all counts. There’s no skipping out on taxes just because a platform is involved. Hosts who keep their rental finances organized, with separate accounts, saved receipts, and clear records,, don’t get caught off guard. The IRS expects you to report everything, 1099 or not.

- Log every booking, even those paid in cash or through alternative platforms.

- Keep a running tally of cleaning fees, supplies, and repairs.

- Set aside a portion of each payout for taxes. Don’t wait until April.

- Use separate bank accounts for rental activity and personal spending.

- Understand that self-employment tax can apply, especially if you provide services beyond a basic rental.

Hosts who ignore these basics end up scrambling for paperwork, missing deductions, or worse, facing penalties. Smart operators treat tax management as seriously as delivering outstanding guest experiences. A clean ledger protects your profits and your peace of mind. If you’re looking for a streamlined approach, our property management team can help you keep your records organized and compliant.

Local Taxes Change the Game

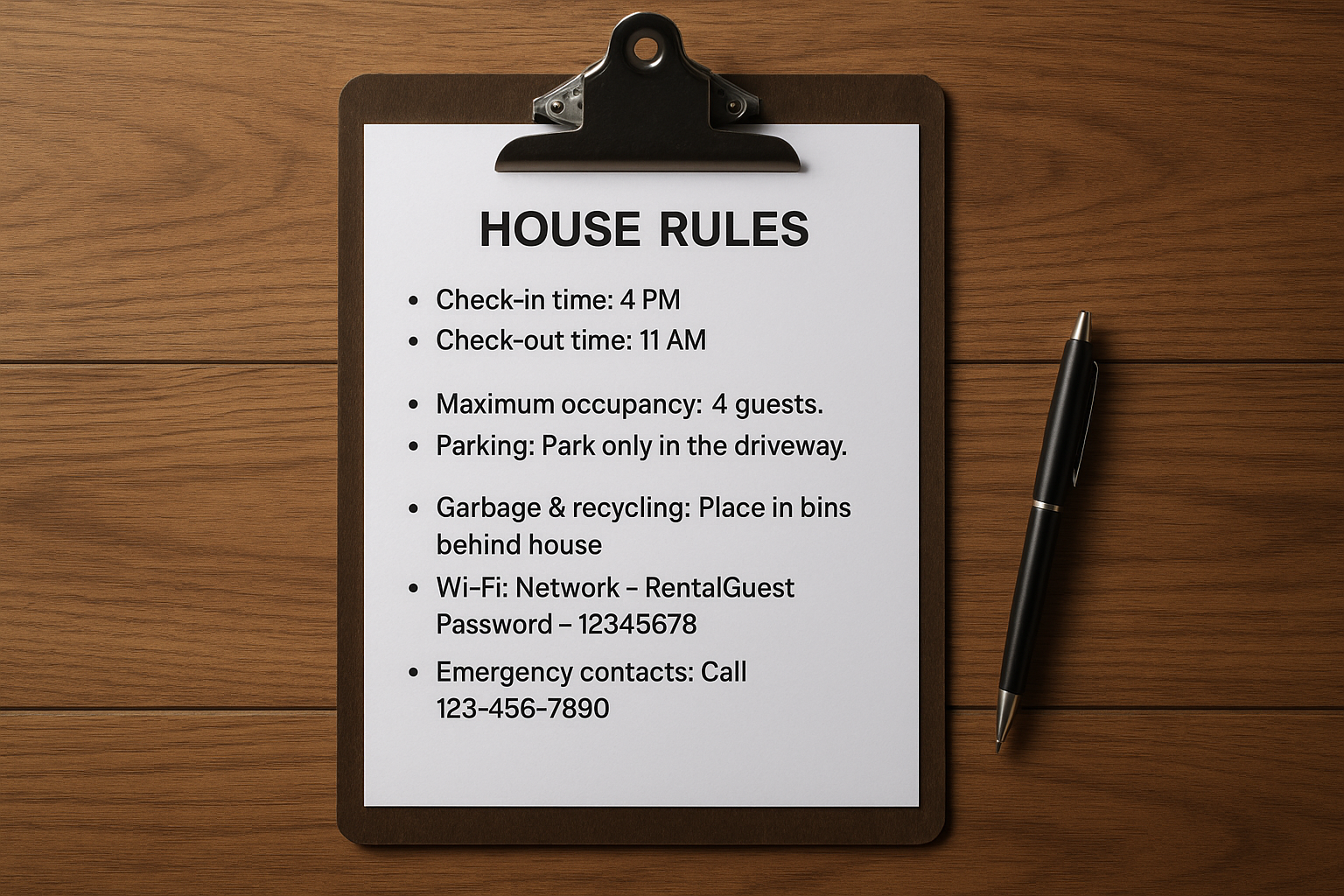

City and county tax rules don’t follow a national script. One city might demand nightly occupancy taxes, while the next town over leaves hosts alone. Some places require you to register as a business, collect taxes from guests, and file monthly returns. Others let Airbnb handle part of the process, but not all of it. Relying on the platform to cover your obligations is a mistake. Local governments expect hosts to know the rules and pay up on time.

Miss a filing deadline or skip a payment, and the penalties stack up fast. Some cities even threaten to revoke rental licenses or fine property owners. Insurance headaches follow when tax compliance slips. Property insurance complications can surface if you’re not following local laws. Hosts who stay ahead of these requirements keep their listings active and their coverage intact. At MainStay Hosts, we stay current on local regulations so your property remains protected and profitable.

- Check city and county websites for short-term rental tax details.

- Register your property if required. Don’t assume you’re exempt.

- Collect and remit occupancy taxes directly when the platform doesn’t handle it.

- Budget for these taxes as a fixed cost, not an afterthought.

- Keep proof of every payment and filing for your records.

Understanding and budgeting for local taxes is as much a part of optimizing your listing as professional photos or guest messaging. The hosts who last in this business know their local rules inside and out.

Real Deductions That Matter

Every expense tied to your rental can work in your favor, if you document it. Mortgage interest, utilities, cleaning, repairs, and even depreciation can shrink your tax bill. But the IRS wants proof. Vague estimates or missing receipts don’t cut it. Hosts who keep digital and paper records, snap photos of receipts, and log every purchase get the most out of their deductions.

Don’t stop at the basics. Many hosts overlook costs like:

- Professional photography for your listing

- Subscription fees for booking platforms or pricing tools

- Travel to and from the property for maintenance or guest issues

- Portions of internet and cable bills used by guests

- Regular property maintenance costs, not just emergency repairs

Depreciation on furniture, appliances, and even the property itself can add up. But these deductions require careful tracking and, sometimes, professional help. The hosts who maximize their returns know exactly what qualifies and keep airtight records all year long. If you’re unsure what qualifies, we can connect you with trusted tax professionals who understand the nuances of short-term rental deductions.

When Professional Help Pays Off

Managing one rental is a challenge. Add a second property, and the paperwork multiplies. Juggling multiple listings, handling upgrades, or splitting time between personal and rental use turns tax prep into a full-time job. That’s when a tax professional becomes essential. They spot deductions you might miss, handle complex filings, and keep you out of trouble with the IRS and local authorities.

Good systems make property management simple. When you work with pros, you get:

- Real-time tracking of every dollar coming in

- Clear records of all expenses and repairs

- Automatic compliance checks that catch issues early

- Problem prevention instead of crisis management

- More time to focus on growing your business

Professional managers do more than collect rent. They build and run systems that protect your investment. They catch small issues before they become big problems. They handle the complex parts while you focus on what matters.

When tax season hits, they:

- File correctly across multiple properties

- Keep up with changing rules

- Plan your payments to avoid surprises

- Back you up if questions come up

You can handle things alone for a while. But growth brings complexity. Smart property owners know when to bring in experts. It frees them to focus on making more money and keeping guests happy.

Get Professional Short-Term Rental Support

Ready to optimize your vacation rental tax strategy? Contact MainStay Hosts at 727-513-0102 or schedule an appointment to discuss your property management needs.

‹ Back